Kenya and South Africa are leading the way in Africa’s shift toward cashless economies, fueled by the rapid growth of digital payment systems, mobile money, and contactless transactions. This trend isn’t limited to Africa; globally, the decline in ATM usage reflects a broader move away from cash.

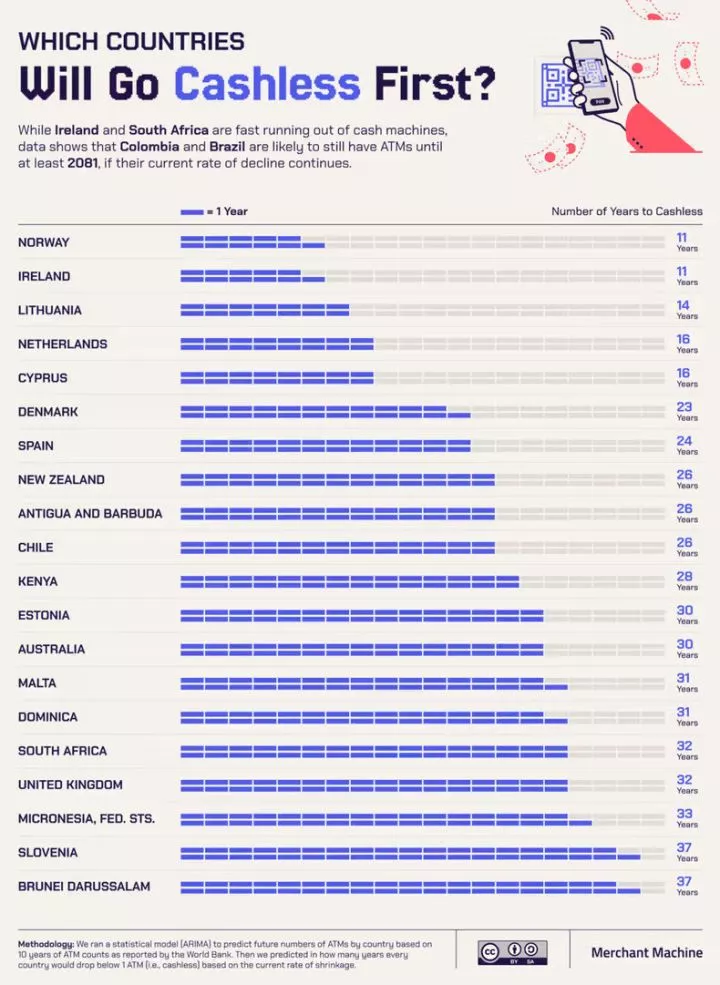

A study by Merchant Machine, based on World Bank data, analyzed the shrinking number of ATMs to predict when countries might become fully cashless. According to the study, Norway could become the first cashless nation in just 11 years if current trends continue. In Africa, Kenya is projected to run out of ATMs in 28 years, while South Africa could follow in 32 years.

Kenya has been a pioneer in digital payments, thanks largely to the success of M-Pesa, a mobile money service launched in 2007 that transformed financial transactions. High mobile phone usage, a growing number of people with bank accounts, and improved financial literacy are further driving Kenya’s transition to a cashless economy.

South Africa is also making significant strides, supported by government initiatives that encourage electronic payments. Despite a large unbanked population, research shows that 95% of South Africans have used digital payment methods at least once.

However, challenges remain. Financial exclusion and the risk of service disruptions are key hurdles that need to be addressed before these countries can achieve fully cashless economies.